-

en

- de

-

The airline consolidation business has quite a specific monetization model. It aims at plane tickets bought wholesale and then resold to travel agencies by retail. Nowadays, these are alive pre-digital era dinosaurs, which are still operable, competing with contemporary internet companies, and even profitable.

In this article, we’ll investigate this phenomenon and find out:

Booking engine included

Most consolidators have their own booking engines, which they offer to their partners. These engines are usually much more user-friendly than the corporate-oriented GDSs, saving significant working time on routine actions every day.

IATA and ARC accredited

Smaller travel agencies often aren’t licensed by IATA/IATAN or ARC. Despite this, partnering with airline consolidators usually allows these agencies to issue new tickets on behalf of airlines.

Creating complex travel products

Just a single consolidator offers airfares from many different airlines. A partnering travel agent can create itineraries of any complexity, combining these vendors at their discretion.

Incredible support quality

Not always, but often, consolidators have high-quality support that is active 24/7. Being in close partnerships with the airlines whose tickets they sell, these consolidators can provide their clients instant help in case of delays, cancellations, or any other unexpected issues.

Airline-grade expertness

Consolidators are mostly mature market players who are very much aware of the industry. This makes them no less valuable airline domain advisors than the airlines’ top managers themselves. Their consultations can be beneficial in terms of routes, regulations, aircraft, best ticket deals, and any other related topics.

Incredible pricing options make all the existing limitations of private tickets unnecessary. This is the main reason for this business model to remain operable. Now, let’s delve deeper into the existing airline consolidators and compare them.

| Details | Aimed at | Partners | Technical assistance offered | |

| Mondee | Established: 2011 HQ: Austin, Texas Offices: 17 across the U.S. and Canada | Leisure travel Business travel | 500+ airlines 100+ hotel aggregators 900k+ properties | TripPro |

| Picasso Travel | Established: 1979 HQ: Los Angeles, California Offices: 6 across the U.S. | Transatlantic flights Long-haul flights Package tours | 72 airlines | A website with a personal account |

| Centrav | Established: 1988 HQ: Burnsville, Minnesota | International flights Complex itineraries | 50 airlines | Booking engine |

| GTT | Established: 1984 HQ: Plano, Texas Offices: 36 across the U.S. | International flights Hotels | 70+ airlines | GTT booking portal |

| Downtown Travel | Established: 1988 HQ: New York, New York Offices: 4 across the U.S. | International flights Package tours | 125 airlines | TheBestAgent.pro |

| Sky Bird | Established: 1976 HQ: Detroit, Michigan Offices: 11 across the U.S., Canada, Philippines, and India | Flights to/from Asia Package tours River cruises | 90+ airlines 1.5M hotels | WINGS booking engine |

Aimed at: leisure travel, business travel

This is the biggest airline consolidator in North America, which acquired 14 travel businesses, including six other consolidators, operating in different regions all over the globe:

Thanks to quite an active position, the company has established relationships with more than 500 carriers. Despite the fact that there are also connections with more than 100 hotel aggregators, covering about 900,000 property units, the rental business accounts for just 10% of the company’s revenue.

One more strong point of Mondee is its software solutions. Currently, the portfolio of the company consists of four tools:

1 TripPro

TripPro is aimed at independent travel agents and travel agencies (сс). The tool allows searching, booking, as well as buying and selling both business and recreational tours. The user interface is adjustable to the agent’s needs. The feature set contains automated ticketing, reports and notifications, as well as a highly sophisticated dynamic pricing option.

2 Rocketrip

Rocketrip is a suite for Enterprise-sized companies. This software takes advantage of their size and enormous resources, saving 20%—30% of corporate travel costs. Such significant savings become available thanks to reward-based encouraging employees to choose the most beneficial trips.

3 TripPlanet

For small- and medium-sized businesses, Mondee offers TripPlanet — a tool for organizing corporate trips on a small scale. According to Mondee, here you can find the exact profitable offers found in Rocketrip for larger clients. The service is paid monthly, but registration is available for invited users only.

4 Unpub

Unpub is the newest software service by Mondee, launched in 2021. This is the solution for end users, who can privately access a significant part of the services previously available for corporate clients.

Aimed at: transatlantic flights, long-haul flights, and package tours

This consolidator has worked for more than 40 years, specializing primarily in long-haul routes, especially transatlantic ones. The second company focus is on package tour distribution.

Picasso Travel earned a reputation as a reliable service provider and one of the leaders within the North American market. Thanks to a strategic partnership with AERTiCKET — the strongest European market player in Berlin — they expand their business presence beyond America.

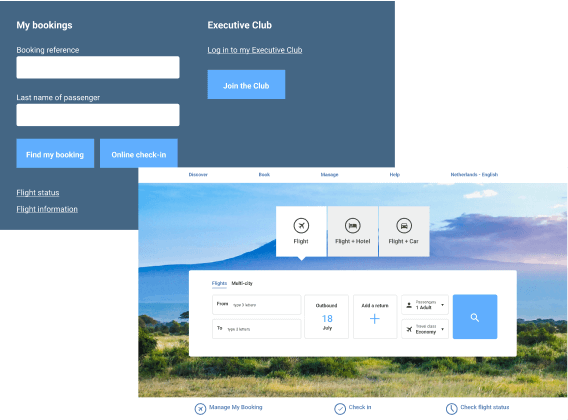

Like the other airline consolidators, Picasso Travel also offers a particular set of online tools. Among them is a personal account and dashboard named Cockpit. Integrated with a proprietary booking engine, the personal account provides access to a string of the main GDS systems.

Aimed at: international flights and complex itineraries

Centrav has been in business since 1988. The company was among the first consolidators that offered their clients the ability to book net fares online. In the early 2000s, the company launched its own branded booking engine. In 2011, they released their first mobile website for travel agents, providing them access to 700 airlines and advantageous offers. A tool named Trip Builder helps customers to create and manage complex itineraries from across the globe.

A ‘2020 and ‘2021 Travvy Award winner, Centrav was recognized as the best air consolidator. Their partnering airlines offer flights from North America to almost everywhere: Latin America, Europe, South Pacific, Africa, the Middle East, Asia, and India. The consolidator agrees with partnering carriers on the number of seats to be sold as an alternative to buying them in bulk. This scenario is only applicable to international flights, which is similar to the majority of wholesalers.

Aimed at: international flights, hotels

Gateway Travel & Tours (GTT) Global is recognized as one of the nationwide most effective aviation consolidation companies. With 40 offices across the country, it assists tour companies with finding the best prices on a variety of routes, creating complex itineraries, and fixing scheduling changes. The company has proven most useful during emergencies since its call centers are open outside regular office hours.

Customer service is provided in English, Chinese, and Vietnamese. The choice of languages indicates the consolidation company is mainly focused on the South East Asian and China routes. Travel agencies are available via their flight booking portal to negotiate domestic and international flights with over 70 carriers, as well as book hotels.

Aimed at: international flights and package tours

Downtown Travel, founded more than 30 years ago in New York City, retains partnerships with 125 airlines flying to and from Europe, Asia, Africa, the Middle East, and India.

The consolidator offers the opportunity for travel agencies to book bargain rates through its B2B OTA-like platform called TheBestAgent.pro. It even has a unit dedicated to leisure travel. Holidays With Downtown offers luxurious festivals and religious, cultural, and other thematic travel packages to more than 75 countries.

Aimed at: flights to/from Asia, package tours, and river cruises

Skybird Travel & Tours is one of the oldest and most highly-recommended global aviation conglomerates. Starting in 1976 in Detroit as a tiny travel company, it has 11 offices across the United States, with sister branches in Canada, India, and the Philippines.

The company ensures smooth operations with its WINGS Booking Engine. It is connected with all the leading GDS, features comparing published and private fare prices side-by-side, as well as automatic ticketing, allowing travel agents to cancel or modify directions easily. In addition to flights, WINGS allows you to book hotels and cars, as well as purchase insurance. Consolidator clients also benefit from the company’s separate Sky Vacations unit, which arranges solo and small-group tours as well as river cruises.

Skybird Travel & Tours recently started offering more flexible payment options with a “Pay Now, Book Later” feature.

Along with the B2B sector, the company also serves end customers. Its Student Fare branch provides cheap plane tickets to students, while Nova Travel specializes in affordable trips for everyone.

Retaining both the airlines’ and the travel agencies’ confidence affects heavily on the financial success of airline consolidators. Let’s decompose this confidence into parts and analyze them.

Complex Online Booking Upgrade for Flagship European Airline

Discover how GP Solutions helped to increase sales volume and customer loyalty by providing development of a brand-new cross-selling module to one of the best-known European airlines.

Airlines frequently behave as though they no longer want the assistance of travel agents, cutting agents’ commissions and trying to use their websites as the main sources of lead generation. But the reality is still harsh for them, forcing carriers to rely on third-party companies more than they want to. As a result, they support a reputation of independence using the hidden aid of consolidators, however, in lower amounts than before.

Although the situation looks stagnating at best for the consolidation business niche, the market players show some signs of adaption to the new reality. Below are four trends that will influence the industry the most.

1 Switching the focus to passengers

Increased competition and rising issues within the B2B sector force airline consolidators to switch their focus to serving end passengers. This is a kind of vertical integration for the business helping to increase revenues and get an additional sales channel.

2 Becoming a “Swiss Army Knife” for travel agencies

Providing additional services for their existing clients seems like another smart way to increase revenue. It’s time for the consolidators to sell not only tickets but also corresponding travel services like car rentals, hotels, package trips, etc.

3 Offering a more customer-faced service

At the dawn of the market, consolidators offered minimal or no customer service. Now, credible companies show an eagerness to assist customers around the clock – through a call center, travel platform, or chatbot.

The next story is quite illustrative here. The flagship European carrier sought assistance in rebuilding its outdated booking system. The GP Solutions team has implemented this crucial update, and we have a story about that.

4 Expanding into online

Growth limitations become the main motivation for such a conservative market, like consolidators to go online. Large wholesalers invest heavily in new tech, developing their own intelligent reservation engines and CRM tools.

Consolidators primarily dependent on brick-and-mortar offices and phone-based help are destined for extinction — as is Thomas Cook. The very first and, at the time, biggest global tour operator suddenly finished its history after 187 years on the market in 2019. Along with Brexit, the number one reason for this crash was the refusal to go online and adapt to a digital world.

Leave your request

We will contact you shortly

Thank you for your request!

We will get back to you as quickly as possible

Get latest insights

from our travel tech experts!

Join 200+ travel fellows! Get GP Solutions' latest articles straight to your inbox. Enter your email address below:

Thank You!